mississippi auto sales tax calculator

Sections 27-65-17 27-65-20 27-65-25 The following are subject to sales tax equal to 7 of the gross proceeds of the retail sales of the business unless otherwise provided. 30000 x05 1500.

Amazon S Cash Flow Behind The Balance Sheet

Mississippi DMV registration fees are about.

. Whether or not you have a trade-in. With local taxes the total sales tax rate is between 7000 and 8000. Average Local State Sales Tax.

Sales Tax Laws Title 27 Chapter 65 Mississippi Code Annotated 27-65-1 Use Tax Laws Title 27 Chapter 67 Mississippi Code Annotated 27-67-1 Sales and Use Tax Regulations. Home Motor Vehicle Sales Tax Calculator. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

26 rows Select location. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. Mississippi Code at Lexis Publishing.

For vehicles that are being rented or leased see see taxation of leases and rentals. Motor vehicle titling and registration. Arizona Base Registration Fee.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. Pay an annual fee of 75 Kokua Line. When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

The state in which you live. Mississippi State Sales Tax. Tax and Tags Calculator.

Home Motor Vehicle Sales Tax Calculator. 56 county city. The tax is based on gross proceeds of sales or gross income depending on the type of business.

Annual with multi-year options. View pg 1 of chart find total for location. Title 35 Part IV Mississippi Administrative Code.

Tax Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200. Tax on a casual sale is based on the assessed value of the vehicle as determined by the most recent assessment schedule. Before engaging in any business in.

The exact taxable value will vary for your vehicle based on the MSRP and the available state tax incentives. 8 150 air quality research fee vehicle license tax assessed value of 60 of the MSRP - reduced by 1625 each year Time Frame. You can find these fees further down on the page.

For additional information click on the links below. Do I have to microchip my dog mississippi vehicle registration fee calculator Oahu mississippi vehicle registration a msb registration renewal fee be. 1275 for renewals and 1400 for.

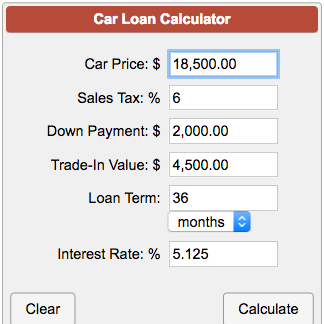

The type of license plates requested. You can calculate the sales tax in Mississippi by multiplying the final purchase price by 05. 65 county city rate on 1st 2500.

Motor Vehicle Ad Valorem Taxes. In addition to taxes car purchases in Mississippi may be subject to other fees like registration title and plate fees. The county the vehicle is registered in.

During the year to deduct sales tax instead of income tax if. Sections 27 65 17 27 65 20 27 65 25 the following are subject to sales tax equal to 7 of the gross proceeds of the retail. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Mississippi Income Tax Calculator 2021. Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200. All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate of tax for an item.

Sales Tax is based on gross proceeds of sales or gross income depending upon the type of business as follows. Maximum Possible Sales Tax. Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government.

New car sales tax OR used car sales tax. Before-tax price sale tax rate and final or after-tax price. Jersey Division of Taxation at 609-984-6206 help calculating your sales tax on the VALUES you SUPPLY easily.

Mississippi car tag renewal. Select Community Details then click Economy to view sales tax rates. For example lets say that you want to purchase a new car for 30000 you would use the following formula to calculate the sales tax.

Motor Vehicle Ad Valorem Taxes. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. Maximum Local Sales Tax.

How to Calculate Mississippi Sales Tax on a Car.

Vehicle Mileage Log Template For Ms Excel Document Hub

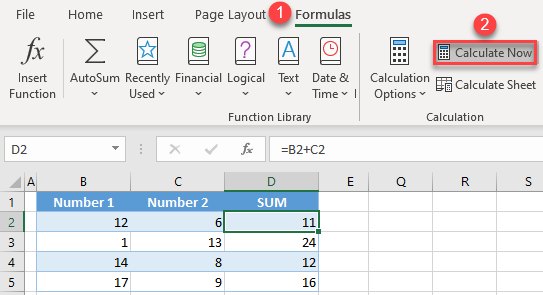

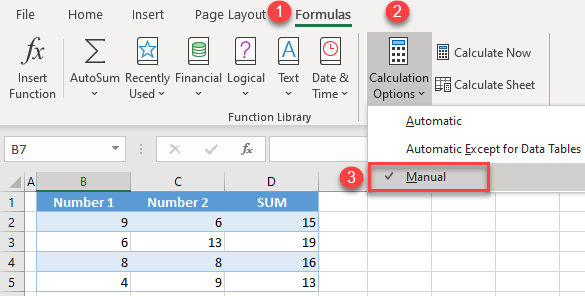

How To Stop Auto Calculation In Excel Automate Excel

Dmv Fees By State Usa Manual Car Registration Calculator

The Really Good Email Design Guide Checklist Email Design Html Email Design Checklist

Free Printable Vehicle Expense Calculator Microsoft Excel

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

View India S Much Abused Taxpayers

Nj Car Sales Tax Everything You Need To Know

How To Stop Auto Calculation In Excel Automate Excel

Invoice Template Ms Excel Auto Calculation Features Etsy Invoice Design Photography Invoice Template Invoice Design Template

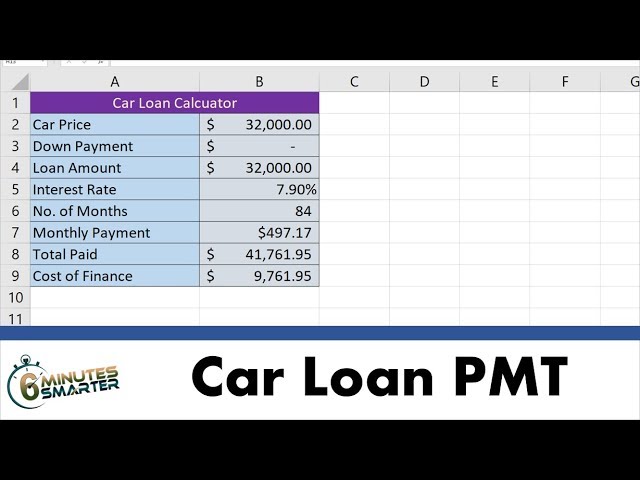

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Vehicle Mileage Log Expense Form Free Pdf Download

Family Practice Management Superbill Template

Auto Loan Calculator For Excel